SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

(Amendment No. )

|

| | | | |

☐Filed by the Registrant x | Filed by a Party other than the Registrant o |

| | | | |

| Check the appropriate box: | | |

| o | | Preliminary Proxy Statement |

☐

o | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

☒

x | | Definitive Proxy Statement |

☐

o | | Definitive Additional Materials |

☐

o | | Soliciting Material Pursuant to§240.14a-12 |

| | | | §240.14a-12 |

| | | | |

| ZOSANO PHARMA CORPORATION |

| (Name of Registrant as Specified in its Charter) |

|

| Not Applicable |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

_______________________

Payment of Filing Fee (Check the appropriate box):

| |

| | |

|

Payment of Filing Fee (Check the appropriate box): |

| | | | |

| |

☒ | x | No fee required. |

| |

☐ | o | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| | | | |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

☐ | o | Fee paid previously with preliminary materials. |

| | |

☐ | o | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

ZOSANO PHARMA CORPORATION

34790 Ardentech Court

Fremont, California 94555

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

We invite you to attend Zosano Pharma Corporation’s 2020 Annual Meeting of Stockholders, which is being held as follows: | | | | |

| | |

| | (1) |

| Date: | Thursday, June 25, 2020 |

| | Amount Previously Paid:

|

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | | | |

| | (3) | | Filing Party:

|

| | | | |

| | (4) | | Date Filed:

|

| | | | |

ZOSANO PHARMA CORPORATION

34790 Ardentech Court

Fremont, California 94555

December 28, 2017

Dear Stockholder:

You are cordially invited to attend a special meeting of Stockholders of Zosano Pharma Corporation which is being held as follows:

| | |

Date:

| | January 23, 2018 |

| |

Time: | | 8:30 a.m., Pacific time |

| |

Location:

| | |

| Location: | Zosano Pharma Corporation

34790 Ardentech Court

Fremont, CA 9455594555* |

Your vote is very important, regardless

At the annual meeting, we will ask our stockholders to:

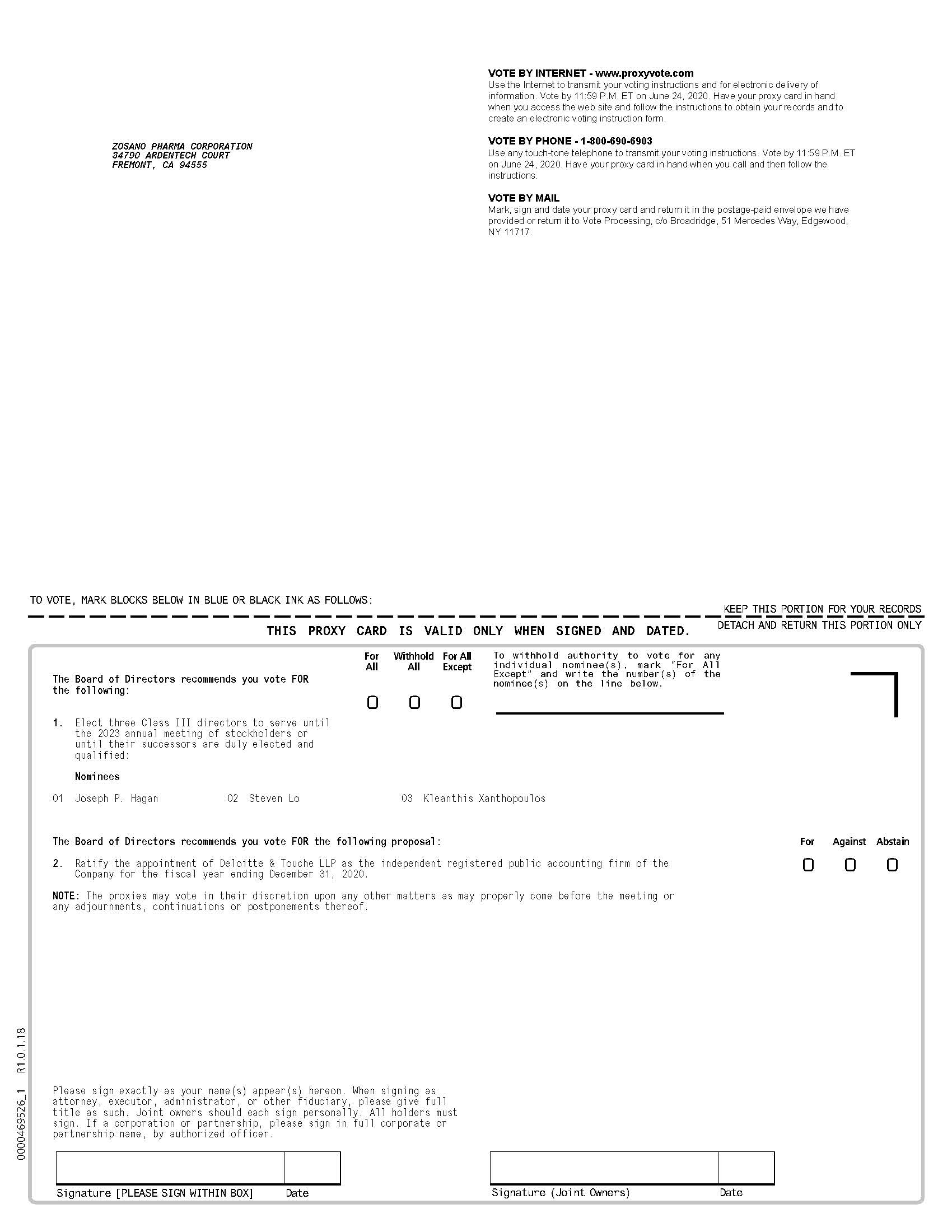

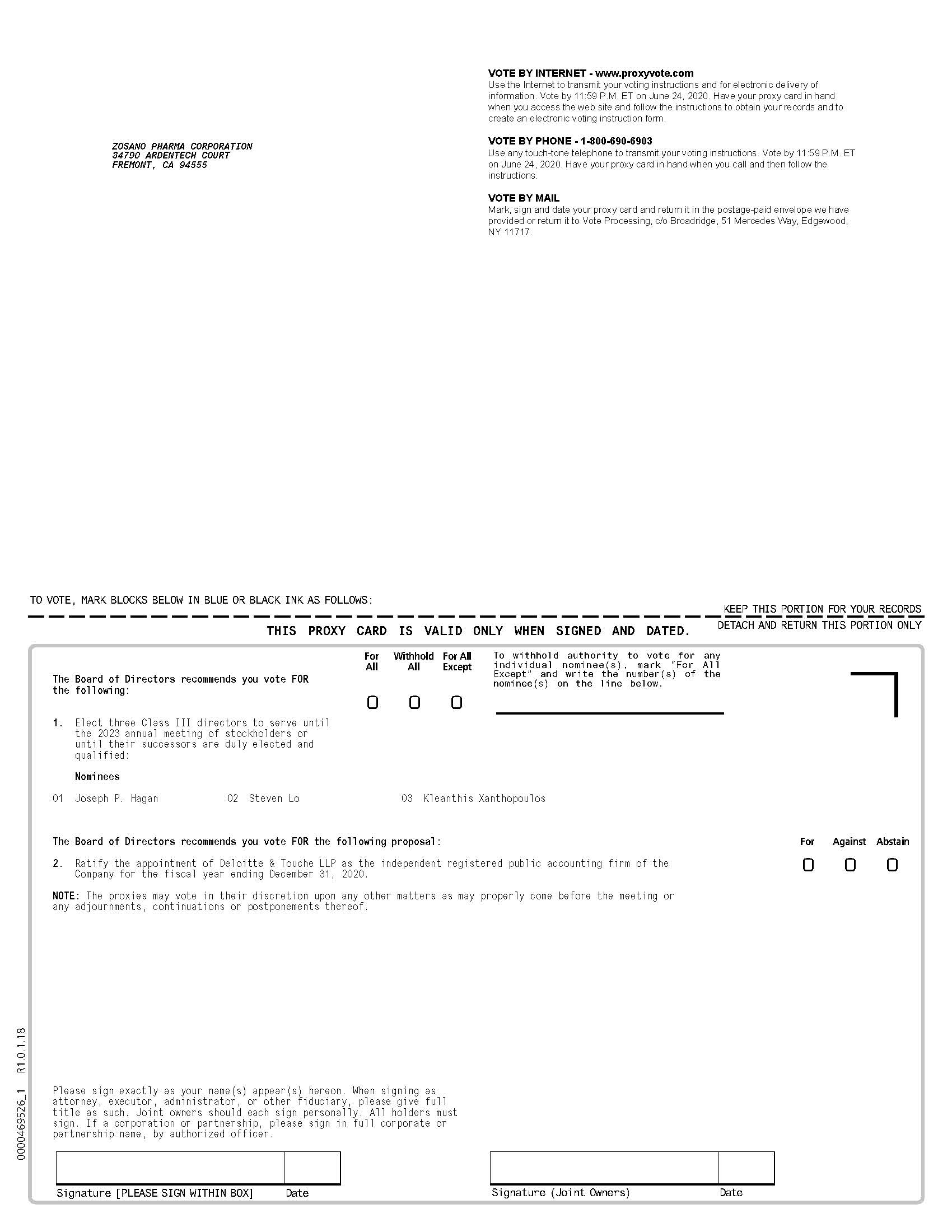

elect Joseph “Jay” P. Hagan, Steven Lo and Kleanthis G. Xanthopoulos, Ph.D., as our Class III directors, to serve for a three-year term ending at our 2023 annual meeting of stockholders;

ratify the numberappointment of shares ofDeloitte & Touche LLP as our voting securities that you own. I encourageindependent registered public accounting firm for our fiscal year ending December 31, 2020; and

consider any other business properly presented at the meeting.

The accompanying proxy statement describes these matters. We urge you to read this information carefully.

You may vote

on these matters in person, by

telephone, overproxy or via the internet or

by marking, signing, datingtelephone. Whether or not you plan to attend the annual meeting, we ask that you promptly complete and

returning yourreturn the enclosed proxy card

in the enclosed addressed, postage-paid envelope or vote via the internet or telephone, so that your shares will be represented and voted at the

special meeting

whether or not you plan to attend.in accordance with your wishes. If you attend the

specialannual meeting, you

will, of course, have the right to revoke themay withdraw your proxy

or internet or telephone vote and vote your shares in person.

If your shares are held in Only stockholders of record at the nameclose of a broker, trust, bank or other nominee, and you receive noticebusiness on May 11, 2020 may vote at the meeting.

By order of the special meeting through your brokerBoard of Directors

Steven Lo

President and Chief Executive Officer

May 29, 2020

* Due to the emerging public health impact of the coronavirus or through another intermediary, please vote or returnCOVID-19, we are planning for the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attendpossibility that the meeting and vote in person. Failuremay be held virtually over the internet. If we take this step, we will announce the decision to do so may result in advance, and details on how to participate will be set forth in a press release issued by us and available on our website at www.zosanopharma.com under “Investors-Press Releases.” As always, we encourage you to vote your shares not being eligibleprior to be voted by proxy at the annual meeting.On behalf

PROXY STATEMENT

ZOSANO PHARMA CORPORATION

2020 ANNUAL MEETING OF STOCKHOLDERS

Table of the board of directors, I urge you to submit your proxy as soon as possible, even if you currently plan to attend the meeting in person.Thank you for your support of our company. I look forward to seeing you at the special meeting.

Contents

PROXY STATEMENT

ZOSANO PHARMA CORPORATION

2020 ANNUAL MEETING OF STOCKHOLDERS

|

John Walker | |

Chairman of the Board of Directors | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDERANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 23, 2018:

Our official Notice of Special Meeting ofJUNE 25, 2020

This proxy statement and our 2019 Annual Report to Stockholders

and Proxy Statement are

also available for viewing, printing and downloading

at:www.edocumentview.com/ZSAN

at www.proxyvote.com and on at www.zosanopharma.com under "Investors-Financials & Filings-Annual Reports and Proxies."

Zosano Pharma Corporation

34790 Ardentech Court

Fremont, California 94555

Telephone: (510)745-1200

NOTICE OF SPECIALINFORMATION ABOUT THE MEETING OF STOCKHOLDERS

To Be Held January 23, 2018

The special meetingMeeting

The 2020 Annual Meeting of Stockholders of Zosano Pharma Corporation

a Delaware corporation,(the "Company," "we," "our" or

the Company,"us") will be held at 8:30 a.m., Pacific

Time,time, on

January 23, 2018,Thursday, June 25, 2020, at

34790 Ardentech Court, Fremont, CA 94555. We are holding the special meeting for the following purposes, which are described in more detail in the accompanying Proxy Statement: | (1) | To amend the Amended and Restated Certificate of Incorporation of the Company to increase the number of authorized shares of common stock from 100,000,000 to 250,000,000, or the Increase in Number of Authorized Shares of Common Stock Proposal. |

| (2) | To approve the proposal to authorize the Company’s board of directors, in its discretion but in no event later than November 23, 2018 (in advance of the expiration of the second 180 calendar day period the Company may be afforded by Nasdaq to regain compliance with the $1.00 minimum bid price continued listing requirement), to amend the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s common stock, at a ratio in the range of1-for-5 to1-for-20, such ratio to be determined by the board of directors and included in a public announcement, or the Reverse Stock Split Proposal. |

| (3) | To approve an adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of any of the foregoing proposals, or the Adjournment Proposal. |

Stockholders are referred to the Proxy Statement accompanying this notice for more detailed information with respect to the matters to be considered at the special meeting. After careful consideration,the board of directors recommends a vote FOR the Increase in Number of Authorized Shares of Common Stock Proposal (Proposal 1); FOR the Reverse Stock Split Proposal (Proposal 2); and FOR the Adjournment Proposal (Proposal 3).

The board of directors has fixed the close of business on December 12, 2017 as the record date. Only holders of record of shares of our common stock on such date are entitled to vote at the special meeting or at any postponement(s) or adjournment(s) of the special meeting.

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If your shares are registered in your name, even if you plan to attend the special meeting or any postponement or adjournment of the special meeting in person, we request that you vote by telephone, over the internet, or complete, sign and mail your proxy card to ensure that your shares will be represented at the special meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive notice of the special meeting through your broker or through another intermediary, please vote or complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the special meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the special meeting.

|

By order of the Board of Directors, |

|

John Walker |

Chairman of the Board of Directors |

December 28, 2017

Zosano Pharma Corporation

34790 Ardentech Court

Fremont, California 94555

Telephone: (510)745-1200

PROXY STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

To Be Held January 23, 2018

Unless the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” the “Company,” or “Zosano” refer to Zosano Pharma Corporation, a Delaware corporation. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist of our common stock, par value $0.0001 per share.

The accompanying proxy is solicited by the board of directors on behalf of Zosano Pharma Corporation, a Delaware corporation, to be voted at a special meeting of stockholders of the Company to be held on January 23, 2018, at the time and place and for the purposes set forth in the accompanying Notice of Special Meeting of Stockholders, or Notice, and at any adjournment(s) or postponement(s) of the special meeting. This Proxy Statement and accompanying form of proxy are expected to be first sent or given to stockholders on or about December 26, 2017.

The executive office of the Company isheadquarters located at and the mailing address of Zosano is, 34790 Ardentech Court, Fremont, California 94555.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON January 23, 2018:

Our official Notice of Special Meeting of Stockholders and Proxy Statement are available for viewing, printing and downloading at:

www.edocumentview.com/ZSAN

ABOUT THE SPECIAL MEETING

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a street name holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the special meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the Securities and Exchange Commission, or the SEC, require that we give to you when we ask you to sign a proxy card to vote your stock at the special meeting.

What is the purpose of the special meeting?

At our special meeting, stockholders will act upon the matters outlined in the Notice, including the following:

| (1) | To amend the Amended and Restated Certificate of Incorporation of the Company to increase the number of authorized shares of common stock from 100,000,000 to 250,000,000. |

| (2) | To approve the proposal to authorize the Company’s board of directors, in its discretion but in no event later than November 23, 2018 (in advance of the expiration of the second 180 calendar day period the Company may be afforded by Nasdaq to regain compliance with the $1.00 minimum bid price continued listing requirement), to amend the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the Company’s common stock, at a ratio in the range of1-for-5 to1-for-20, such ratio to be determined by the board of directors and included in a public announcement. |

| (3) | To approve an adjournment of the special meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of any of the foregoing proposals. |

What is “householding” and how does it affect me?

With respect to eligible stockholders who share a single address, we may send only one Notice or Proxy Statement to that address unless we receive instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate Notice or Proxy Statement in the future, he or she may contact Zosano Pharma Corporation, 34790 Ardentech Court, Fremont, California 94555, Attention: Georgia Erbez, Chief Business Officer and Chief Financial Officer, telephone: (510)745-1200. Eligible94555. At the meeting, stockholders of record receiving multiple copies of our Notice or Proxy Statement can request householding by contacting us in the same manner. Stockholders who own shares through a bank, broker or other nominee can request householding by contacting the nominee.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the Notice or Proxy Statement to a stockholder at a shared address to which a single copy of the document was delivered. Requests should be directed to us at the address or phone number set forth above.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of the Notice or this Proxy Statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account

in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a Notice for shares held in your name and a notice or voting instruction card for shares held in street name. Please follow the directions provided in the Notice and each additional notice or voting instruction card you receive to ensure that all your shares are voted.

What ison the record date for the meeting who are present or represented by proxy will have the opportunity to vote on the following matters:

to elect Joseph “Jay” P. Hagan, Steven Lo and

what does it mean?The record dateKleanthis G. Xanthopoulos, Ph.D., as our Class III directors, to determineserve for a three-year term ending at our 2023 annual meeting of stockholders;

to ratify the stockholders entitledappointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020; and

consider any other business properly presented at the meeting.

Due to noticethe emerging public health impact of the coronavirus or COVID-19, we are planning for the possibility that the meeting may be held virtually over the internet. If we take this step, we will announce the decision to do so in advance, and details on how to participate will be set forth in a press release issued by us and available on our websiteat www.zosanopharma.com under “Investors-Press Releases.”As always, we encourage you to vote your shares prior to the annual meeting.

This Proxy Solicitation

We have sent you this proxy statement and the enclosed proxy card because our Board of Directors is soliciting your proxy to vote at the special meeting (including any adjournment or postponement of the meeting).

This proxy statement summarizes information about the proposals to be considered at the meeting and other information you may find useful in determining how to vote.

The proxy card is the close of business on December 12, 2017. The record date was establishedmeans by the board of directors as required by Delaware law. On the record date, 39,460,931 shares of common stock were issued and outstanding.Who is entitledwhich you authorize another person to vote your shares at the special meeting?

meeting in accordance with your instructions.

We will pay the cost of soliciting proxies. Our directors, officers and employees may solicit proxies in person, by telephone or by other means. We will reimburse brokers and other nominee holders of shares for expenses they incur in forwarding proxy materials to the beneficial owners of those shares. We do not plan to retain the services of a proxy solicitation firm to assist us in this solicitation.

We will mail this proxy statement and the enclosed proxy card to stockholders for the first time on or about May 29, 2020. In this mailing, we will include a copy of our 2019 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2019 (excluding exhibits), as filed with the Securities and Exchange Commission, or SEC.

Who May Vote

Holders of record of our common stock at the close of business on May 11, 2020 are entitled to one vote per share of common stock on each proposal properly brought before the record dateannual meeting.

A list of stockholders entitled to vote will be available at the annual meeting. In addition, you may contact our Chief Executive Officer, Steven Lo, at our principal executive offices located at 34790 Ardentech Court, Fremont, California 94555, to make arrangements to review a copy of the stockholder list at our offices, between the hours of 9:00 a.m. and 5:30 p.m., Pacific time, on any business day from June 15, 2020 to the time of the annual meeting.

How to Vote

You are entitled to one vote at the

special meeting.How many votes do I have?

On each matter to be voted upon, you have one votemeeting for each share of common stock you own as of the record date.

What is the quorum requirement?

Atregistered in your name at the close of business on December 12, 2017, 39,460,931May 11, 2020, the record date for the meeting. You may vote your shares of our common stock were outstanding. Our Amended and Restated Bylaws require that a majority of the outstanding shares of our common stock entitled to vote be represented, in person or by proxy, at the special meeting in order to constitute the quorum we need to transact business at the special meeting. We will count abstentions and brokernon-votes as shares represented at the meeting in determining whether a quorum exists.

What isperson, by proxy, via the difference between a stockholderinternet or via the toll-free number (for residents of the United States and Canada) listed on your proxy card.

To vote in person, you must attend the meeting, and then complete and submit the ballot provided at the meeting.

To vote by proxy, you must complete and return the enclosed proxy card. Your proxy card will be valid only if you sign, date and return it before the meeting. By completing and returning the proxy card, you will direct the persons named on the proxy card to vote your shares at the meeting in the manner you specify. If you complete all of the proxy card except the voting instructions, then the designated persons will vote your shares FOR the election of Mr. Hagan, Mr. Lo and Dr. Xanthopoulos as Class III directors and FOR the ratification of Deloitte and Touche LLP as our independent registered public accounting firm. If any other business properly comes before the meeting, then the designated persons will have the discretion to vote in any manner they deem appropriate.

To vote via the internet, you must access the website for internet voting at www.proxyvote.com. Please have the enclosed proxy card handy when you access the website, and then follow the on-screen instructions. Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m. (Eastern time) on June 24, 2020. If you vote via the internet, you do not have to return your proxy card via mail.

To vote via telephone, use any touch-tone telephone and call 1 (800) 690-6903 to transmit your voting instructions up until 11:59 p.m. (Eastern time) on June 24, 2020. Please have the enclosed proxy card handy when you call, and then follow the instructions. If you vote via telephone, you do not have to return your proxy card via mail.

If you vote by proxy or via the internet or telephone, you may revoke your vote at any time before it is exercised by taking one of the following actions:

sending written notice to our Chief Executive Officer at our address set forth on the notice of meeting appearing on the cover of this proxy statement;

voting again by proxy or via the internet or telephone on a

“street name” holder?If your shares are registered directly in your name with Computershare,later date; or

attending the meeting, notifying our stock transfer agent,Chief Executive Officer that you are consideredpresent, and then voting in person.

Shares Held by Brokers or Nominees

If the

stockholder of record with respect to those shares. The Proxy Statement has been sent directly toshares you

by us.If your sharesown are held in a stock brokerage account or“street name” by a bank or other nominee, the nominee is consideredbrokerage firm, your brokerage firm, as the record holder of those shares. You are considered the beneficial owner of these shares, and your shares, are held in “street name.” A notice or Proxy Statement and voting instruction card have been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning howis required to vote your shares by using the voting instructions they included in the mailing or by following their instructions for voting by telephone or the internet. To vote by proxy oraccording to instruct your broker howinstructions. In order to vote your shares, you shouldwill need to follow the directions your brokerage firm provides to you. Many brokers also offer the option of providing voting instructions to them over the internet or by telephone, directions for which would be provided with theby your brokerage firm on your voting instruction card.

What is a brokerform.

non-vote?Brokernon-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under stock exchange rules applicable to most brokerage firms, if you do not give instructions to your broker, it is permitted to vote any shares it holds for your account in its discretion with respect to “routine” proposals, but it is not allowed to vote your shares with respect to certain non-routine proposals. non-routine proposals.

If I amProposal 1, regarding the election of directors is a beneficial owner of shares, can my brokerage firm vote my shares?

“non-routine” proposal. If you are a beneficial owner and do not vote via the internet or telephone or by returning a signed voting instruction card toinstruct your broker your shares may be voted onlyhow to vote with respect toso-called “routine” matters where Proposal 1, your broker has discretionary voting authority over your shares.

We encourage you to provide instructions to your brokerage firm via the internet or telephone or by returning your signed voting instruction card. This ensures thatwill not vote on this proposal and your shares will be voted atrecorded as “broker non-votes” and will not affect the special meetingoutcome of the vote on Proposal 1. “Broker non-votes” are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that, while voting in its discretion on one matter, it does not have or did not exercise discretionary authority to vote on another matter.

Proposal 2, the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, is considered to be a “routine” item under the applicable rules and your broker will be able to vote on that item even if it does not receive instructions from you, so long as it holds your shares in its name.

If a broker or nominee holds shares of our common stock in “street name” for your account, then this proxy statement may have been forwarded to you with a voting instruction card, which allows you to instruct the broker or nominee how to vote your shares on the proposals described herein. To vote by proxy or to instruct your broker how to vote, you should follow the directions provided with the voting instruction card. In order to have your vote counted on Proposals 1 and 2, you must either provide timely voting instructions to your broker or obtain a properly executed proxy from the broker or other record holder of the shares that authorizes you to act on behalf of the record holder with respect to all of the proposals described in this Proxy Statement.How do I vote my shares?

You are entitledshares held for your account.

Quorum Required to one vote at the meeting for each share of common stock registered in your name atTransact Business

At the close of business on December 12, 2017,May 11, 2020, 54,361,635 shares of our common stock were outstanding. Our Bylaws require that a majority of the record date for the meeting. You may vote youroutstanding shares of our common stock be represented, in person, by remote communication, if applicable, or by proxy, at the meeting in order to constitute the quorum we need to transact business at the meeting. We will count abstentions and broker non-votes as shares represented at the meeting in determining whether a quorum exists.

Votes Required

Proposal 1 - Election of Directors. Directors will be elected by a plurality of the votes of the shares present in person, by remote communication, if applicable, or represented by proxy viaat the internetmeeting and entitled to vote. Stockholders will be given the choice to vote “for” or via“withhold” votes for each nominee. Thus, the toll-freenominees receiving the greatest number (for residentsof votes “FOR” their election will be elected. Broker non-votes are not considered votes entitled to vote and therefore will not affect the outcome of the United States and Canada) listed on your proxy card. | • | | To vote in person, you must attend the meeting, and then complete and submit the ballot provided at the meeting. |

| • | | To vote by proxy, you must complete and return the enclosed proxy card. Your proxy card will be valid only if you sign, date and return it before the meeting. By completing and returning the proxy card, you will direct the persons named on the proxy card to vote your shares at the meeting in the manner you specify. If you complete all of the proxy card except one or more of the voting instructions, then the designated proxies will vote your shares as to which you provide no voting instructions in the manner described under “What if I do not specify how I want my shares voted?” below. If any other business properly comes before the meeting, then the designated persons will have the discretion to vote in any manner they deem appropriate. |

| • | | To vote via the internet,you must access the website for internet voting at www.investorvote.com/ZSAN. Please have the enclosed proxy card handy when you access the website, and then follow theon-screen instructions. Internet voting facilities for stockholders of record will be available 24 hours a day until 1:00 a.m. (Central time) on January 23, 2018. If you vote via the internet, you do not have to return your proxy card via mail. |

| • | | To vote via telephone, use any touch-tone telephone and call1-800-652-VOTE (8683) to transmit your voting instructions up until 1:00 a.m. (Central time) on January 23, 2018. Please have the enclosed proxy card handy when you call, and then follow the instructions. If you vote via telephone, you do not have to return your proxy card via mail. |

Even if you currently plan to attend the special meeting, we recommend that you vote by telephone or internet or return your proxy card or voting instructions as described above so that your votes will be counted if you later decide not to attend the special meeting or are unable to attend.

Who counts the votes?

All votes will be tabulated by the inspectorvote.

Proposal 2 - Ratification of election appointed by the boardAppointment of directors for the special meeting. Each proposal will be tabulated separately.What are my choices when voting?

As to each of the Increase in Number of Authorized Shares of Common Stock Proposal, the Reverse Stock Split Proposal and the Adjournment Proposal, stockholders may vote for the proposal, against the proposal, or abstain from voting on the proposal.

What are the board of directors’ recommendations on how I should vote my shares?

Independent Registered Public Accounting Firm. The board of directors recommends that you vote your shares as follows:

Proposal 1—FOR the Increase in Number of Authorized Shares of Common Stock Proposal.

Proposal 2—FOR the Reverse Stock Split Proposal.

Proposal 3—FOR the Adjournment Proposal.

What if I do not specify how I want my shares voted?

If you are a record holder who returns a completed proxy card that does not specify how you want to vote your shares on one or more proposals, the designated proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following manner:

Proposal 1—FOR the Increase in Number of Authorized Shares of Common Stock Proposal.

Proposal 2—FOR the Reverse Stock Split Proposal.

Proposal 3—FOR the Adjournment Proposal.

If you are a street name holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee may be able to vote those shares. See “What is a brokernon-vote?”

Can I change my vote?

Yes. If you are a record holder, you may revoke your proxy at any time by any of the following means:

Attending the special meeting and voting in person. Your attendance at the special meeting will not by itself revoke a proxy. You must vote your shares by ballot at the special meeting to revoke your proxy.

Voting again by telephone or over the internet (only your latest telephone or internet vote submitted prior to the special meeting will be counted).

If you requested and received written proxy materials, completing and submitting a new valid proxy bearing a later date.

Sending written notice to our Secretary at our address set forth on the notice of meeting appearing on the cover of this Proxy Statement.

If you are a street name holder, your bank, broker or other nominee should provide instructions explaining how you may change or revoke your voting instructions.

What percentage of the vote is required to approve each proposal?

Approval of each of the Increase in Number of Authorized Shares of Common Stock Proposal and the Reverse Stock Split Proposal will require the affirmative vote of thea majority of shares present in person, by remote communication, if applicable, or represented by proxy at the meeting and entitled to vote generallyis required for the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. Abstentions will have the same effect as a vote against this proposal. Brokers have authority in the absence of timely instructions from their beneficial owners to vote on this proposal. As a result, there will be no broker non-votes for this proposal.

What Happens if a Change to the Annual Meeting is Necessary Due to Exigent Circumstances?

While we have every intention of holding the annual meeting as indicated in the “Notice of 2020 Annual Meeting of Stockholders,” if exigent and unexpected circumstances, such as a global health crisis like COVID-19, prevent us from holding the annual meeting as planned, we may determine to change the location of the annual meeting or to switch to an alternative method of holding the meeting, such as a virtual meeting. If we need to take such action on an exceptional basis, we plan on issuing a press release notifying our stockholders of such development, which will be available on our websiteat www.zosanopharma.com under “Investors-Press Releases.” Any such decision by us has no impact on a stockholder’s ability to provide their proxy by using the internet or telephone or by completing, signing, dating and mailing their proxy card, each as explained in this proxy statement.

Householding of Annual Meeting Materials

Some banks, brokers, and other nominee record holders may be “householding” our proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to stockholders may have been sent to multiple stockholders in your household. We will promptly deliver a copy of either document to you if you write or call us at our principal executive offices, 34790 Ardentech Court, Fremont, California 94555, Attention: Steven Lo, President and Chief Executive Officer, telephone: (510) 745-1200. In the future, if you want to receive separate copies of the proxy statement or annual report to stockholders, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and telephone number.

Annual Report on Form 10-K

We will promptly deliver to you a copy of our Annual Report on Form 10-K for the year ended December 31, 2019 and additional copies of our proxy statement, without charge, if you write or call us at the following address or telephone number: Zosano Pharma Corporation, 34790 Ardentech Court, Fremont, California 94555, Attention: Steven Lo, President and Chief Executive Officer, telephone: (510) 745-1200.

PROPOSAL 1: ELECTION OF DIRECTORS

The first proposal on the subject matter. The approvalagenda for the annual meeting is the election of Joseph “Jay” P. Hagan, Steven Lo and Kleanthis G. Xanthopoulos, Ph.D. to serve as Class III directors.

Our Board of Directors is divided into three classes:

Linda Grais M.D., J.D. and John P. Walker are Class I directors whose terms end at our annual meeting of stockholders in 2021;

Steven A. Elms and Kenneth R. Greathouse are Class II directors whose terms end at our annual meeting of stockholders in 2022; and

Joseph “Jay” P. Hagan, Steven Lo and Kleanthis G. Xanthopoulos, Ph.D. are Class III directors whose terms end at this year’s annual meeting of stockholders.

At each annual meeting of stockholders, a Class of directors is elected for a three-year term to succeed the directors of the Adjournment Proposal requiressame Class whose terms are then expiring. The term of the affirmative voteClass III director elected at our 2020 annual meeting of stockholders will begin at the meeting and end at our 2023 annual meeting of stockholders, or, if later, when such director’s successor has been elected and has qualified.

The following table sets forth certain information as of May 11, 2020 regarding our Class III directors, who have been nominated for election, and each other director who will continue in office following the 2020 Annual Meeting of Stockholders.

|

| | | | | |

| Name | | Age | | Position(s) |

| Class III Director Nominees | | | | |

Joseph “Jay” P. Hagan (1) | | 51 |

| | Director, Audit Committee Chair |

| Steven Lo | | 53 |

| | President, Chief Executive Officer and Director |

Kleanthis G. Xanthopoulos, Ph.D. (2) | | 62 |

| | Director, Compensation Committee Chair |

| Continuing Directors | | | | |

| John P. Walker | | 71 |

| | Chairman of the Board of Directors |

Steven A. Elms (2) (3) | | 56 |

| | Director |

Linda Grais M.D., J.D. (1) (3) | | 63 |

| | Director, Nominating and Corporate Governance Committee Chair |

Kenneth R. Greathouse (1) (2) (3) | | 67 |

| | Director |

(1)Member of the Audit Committee

(2)Member of the Compensation Committee

(3)Member of the Nominating and Corporate Governance Committee

Class III Director Nominees

Joseph “Jay” P. Hagan has served as a member of our Board of Directors since May 2015. Mr. Hagan has served as Chief Executive Officer of Regulus Therapeutics Inc., a publicly-held clinical-stage biopharmaceutical company, since May 2017. Previously, he served as Regulus’s Chief Operating Officer, Principal Financial Officer and Principal Accounting Officer since January 2016. From 2011 to December 2015, Mr. Hagan served as Orexigen Therapeutics, Inc.’s Chief Business & Financial Officer. From May 2009 to June 2011, Mr. Hagan served as Orexigen’s Senior Vice President, Corporate Development, Strategy and Communications. Prior to Orexigen, Mr. Hagan worked at Amgen Inc., a publicly-held biopharmaceutical company, from September 1998 to April 2008, where he served in various senior business development roles, including founder and Managing Director of Amgen Ventures. Prior to starting the Amgen Ventures fund, Mr. Hagan was Head of Corporate Development at Amgen, leading such notable transactions as the acquisition of Immunex and Tularik and the spinouts of Novatrone and Relypsa, as well as numerous other business development efforts totaling over $15 billion in value. Before joining Amgen, Mr. Hagan spent five years in the bioengineering labs at Genzyme and Advance Tissue Sciences. He has served as a member of the Board of Directors of Aurinia Pharmaceuticals, Inc., a publicly-held clinical stage biopharmaceutical company, since February 2018, and a member of the Board of Directors of Regulus since June 2017. Mr. Hagan received a B.S. in Physiology and Neuroscience from the University of California, San Diego and a M.B.A from Northwestern University. We believe that Mr. Hagan’s education and professional background in science and business management, and his work as a senior executive in the biotechnology industry qualify him to serve as a member of our Board of Directors.

Steven Lo has served as our President and Chief Executive Officer and as a member of our Board of Directors since October 2019. Previously, from September 2015 to October 2019, Mr. Lo served as Chief Commercial Officer of Puma Biotechnology, Inc., a publicly-held biopharmaceutical company. Prior to joining Puma, Mr. Lo held a number of positions at Corcept Therapeutics Incorporated, a publicly-held pharmaceutical company, from September 2010 to September 2015, including Senior Vice President, Oncology, Senior Vice President & Chief Commercial Officer and Vice President & Head of Commercial Operations. Prior to Corcept, Mr. Lo was with Genentech, Inc. from December 1997 to September 2010. At Genentech, Mr. Lo held a number of positions, including Senior Director, Oncology Marketing, where he prepared and led the first U.S. launch of Herceptin® in adjuvant HER2-positive breast cancer. His other leadership roles at Genentech included Franchise Head, Endocrinology and Senior Director of Managed Care. Mr. Lo received a B.S. in Microbiology from the University of California, Davis and a Master of Health Administration from the University of Southern California. We believe that Mr. Lo’s perspective as our President and Chief Executive Officer qualifies him to serve as a member of our Board of Directors.

Kleanthis G. Xanthopoulos, Ph.D. has served as a member of our Board of Directors since April 2013. Dr. Xanthopoulos is a serial entrepreneur whose passion is building healthcare companies focused on innovation. Dr. Xanthopoulos has over two decades of experience in the biotechnology and pharmaceutical research industries as an executive, company founder, chief executive officer, investor and board member. He has founded three companies, has introduced two life science companies to Nasdaq and has financed and brokered numerous creative strategic alliance and partnership deals with large pharmaceutical partners. Dr. Xanthopoulos has served as the President and CEO of IRRAS AB, a commercial stage medical device and drug delivery company, since June 2015 and has served as Managing General Partner at Cerus DMCC since August 2015, which focuses on investing and building innovative biotechnology companies. Dr. Xanthopoulos served as President and Chief Executive Officer of Regulus Therapeutics Inc. (Nasdaq: RGLS) from the time of its formation in 2007 until June 2015. Prior to that, he was a managing director of Enterprise Partners Venture Capital. Dr. Xanthopoulos co-founded and served as President and Chief Executive Officer of Anadys Pharmaceuticals, Inc. (Nasdaq: ANDS) from its inception in 2000 to 2006 and remained a Director until its acquisition by Roche in 2011. He was Vice President at Aurora Biosciences (acquired by Vertex Pharmaceuticals, Inc.) from 1997 to 2000. Dr. Xanthopoulos participated in The Human Genome Project as a Section Head of the National Human Genome Research Institute from 1995 to 1997. Prior to this, Dr. Xanthopoulos was an Associate Professor at the Karolinska Institute, in Stockholm, Sweden, after completing a Postdoctoral Research Fellowship at The Rockefeller University, New York. An Onassis Foundation scholar, he was named the E&Y Entrepreneur of the year in 2006 in San Diego and the San Diego Business Journal’s Most Admired mid-size company CEO in 2013. Dr. Xanthopoulos received his B.Sc. in Biology with honors from Aristotle University of Thessaloniki, Greece, and received both his M.Sc. in Microbiology and Ph.D. in Molecular Biology from the University of Stockholm, Sweden. In addition to his roles at IRRAS AB, Dr. Xanthopoulos is a director of LDO S.p.a. (Milan, Italy), and is the co-founder and a member of the Board of Directors of privately held Sente Inc. We believe that Dr. Xanthopoulos’s senior executive experience managing and developing a major biotechnology company and his extensive industry knowledge and leadership experience in the biotechnology industry qualify him to serve as a member of our Board of Directors.

Continuing Directors

John P. Walker has served as a member of our Board of Directors since May 2016. From August 2017 to October 2019, Mr. Walker served as our President and Chief Executive Officer, and he served as our Interim Chief Executive Officer from May 2017 to August 2017. Mr. Walker has served as Chairman of Vizuri Health Sciences, LLC since March 2016 and Chairman of the Boards of Propella Therapeutics Inc. and Vizuri Health Sciences Consumer Health Inc. since May 2020. He also previously served as a Managing Director of Four Oaks Partners, a life sciences transaction advisory firm, which he co-founded in March 2012, until January 2015. As part of his activities with Four Oaks Partners, Mr. Walker served as the Chairman and Interim Chief Executive Officer of Neuraltus Pharmaceuticals, Inc., a privately held biopharmaceutical company, until October 2013. From February 2009 until July 2010, Mr. Walker was the Chief Executive Officer at iPierian Inc., a company focused on the use of inducible stem cells for drug discovery. From 2006 until 2009, Mr. Walker served as the Chairman and Chief Executive Officer of Novacea, Inc., a pharmaceutical company that merged with Trancept Pharmaceuticals, Inc. in 2009. Since 2001, Mr. Walker, acting as a consultant, was Chairman and Interim Chief Executive Officer at Kai Pharmaceuticals, Guava Technologies, Centaur Pharmaceuticals, Inc., and Chairman and Chief Executive Officer of Bayhill Therapeutics. From 1993 until 2001, Mr. Walker was the Chairman and Chief Executive Officer of Arris Pharmaceuticals Corporation and its successor, Axys Pharmaceuticals Inc. Mr. Walker previously served on the Board of Directors of Geron Corporation and Evotec AG. Mr. Walker currently serves on the Board of Directors of Lucile Packard Children's Hospital at Stanford University, is the Chairman of Packard Children's Health Alliance, and is a member of the Board of Trustees at the University of Puget Sound. Mr. Walker received a B.A. from the State University of New York at Buffalo and is a graduate of the Advance Executive Program at the Kellogg School of Management at Northwestern University. We believe Mr. Walker’s 40 years in the life sciences industry and his experience as Chairman and Chief Executive Officer of a majoritynumber of development and commercial stage companies, including his prior service as our President and Chief Executive Officer, qualify him to serve as a member of our Board of Directors.

Steven A. Elms has served as a member of our Board of Directors since May 2018. He currently serves as a Managing Partner of Aisling Capital LLC, a private equity firm. He joined Aisling Capital LLC in 2000 from the life sciences investment banking group of Chase H&Q (formerly Hambrecht and Quist Group Inc.) where he was a principal. Mr. Elms has served on the Board of Directors of ADMA Biologics, Inc., a publicly-held commercial biopharmaceutical company, since July 2007. Previously, Mr. Elms served on the Board of Directors of Loxo Oncology from 2013 to 2019, Ambit Biosciences Corp. from 2001 to 2014, MAP Pharmaceuticals, Inc. from 2004 to 2011 and has served on the boards of directors of a number of private companies. Mr. Elms received a B.A. in Human Biology from Stanford University and a M.B.A. from the Kellogg School of Management at Northwestern University. We believe that Mr. Elms's extensive financial services background and experience in the pharmaceutical and healthcare industries equip him to serve on our Board of Directors.

Linda Grais has served as a member of our Board of Directors since January 2019. She currently serves on the Board of Directors of Arca Biopharma and Corvus Pharmaceuticals, both publicly-held biopharmaceutical companies, and PRA Health Sciences, a publicly-held contract research organization. From 2012 to 2017, Dr. Grais was President, Chief Executive Officer, and a member of the Board of Directors of Ocera Therapeutics, Inc., a biopharmaceutical company, which was acquired by Mallinckrodt, a pharmaceutical company, in 2017. Prior to her employment by Ocera, Dr. Grais served as a Managing Member at InterWest Partners, a venture capital firm, from 2005 until 2011, investing in biotechnology and medical device companies. From July 1998 to July 2003, Dr. Grais was a founder and executive vice president of SGX Pharmaceuticals Inc., a drug discovery company, which was acquired by Eli Lilly & Co., a pharmaceutical company, in 2008. Prior to that, she worked as an attorney at Wilson Sonsini Goodrich & Rosati, where she represented Life Science companies. Before practicing law, Dr. Grais worked as an assistant clinical professor of Internal Medicine and Critical Care at the University of California, San Francisco. Dr. Grais received a B.A. from Yale University, an M.D. from Yale Medical School and a J.D. from Stanford Law School. We believe that Dr. Grais’s extensive experience in the biopharmaceutical industry and as an executive officer of pharmaceutical and biotechnology companies qualifies her to serve as a member of our Board of Directors.

Kenneth R. Greathouse has served as a member of our Board of Directors since October 2017. Mr. Greathouse co-founded and has served as President of Argent Development Group since 2004, co-founded and has served as Chief Executive Officer of Melbourne Laboratories since 2012, co-founded and has served as Chief Executive Officer of Valcrest Pharmaceuticals since 2015 and co-founded and has served as Chief Executive Officer of Hesperian BioPharma since 2015. Mr. Greathouse has served as a member of the Board of Directors of Grove Sleep Holdings since 2009 and as a member of the Board of Directors of Optime Care since 2020. Mr. Greathouse received a B.S. from the University of California, Berkeley. We believe that Mr. Greathouse’s extensive experience in the pharmaceutical industry and as an executive officer of pharmaceutical and biotechnology companies qualifies him to serve as a member of our Board of Directors.

If for any reason any of the nominees becomes unavailable for election, the persons designated in the proxy card may vote the shares represented by proxy for the election of a substitute nominated by the Board of Directors. Each of the nominees has consented to serve as a director if elected, and we currently have no reason to believe that a nominee will be unable to serve.

Directors will be elected by a plurality of the votes of the shares present in person, by remote communication, if applicable, or represented by proxy at the

meeting.How are abstentions and brokernon-votes treated?

Abstentions and brokernon-votes, are included in the determination of the number of shares present at the special meeting for determining a quorum at the meeting. Abstentions and brokernon-votes will have the same

effect as a voteAGAINST the Increase in Number of Authorized Shares of Common Stock Proposal and the Reverse Stock Split Proposal because such proposals require an affirmative vote by a majority of the shares outstanding and entitled to vote. A brokernon-vote or a failureThe nominees receiving the greatest number of votes “FOR” their election will be elected as Class III directors. Broker non-votes are not considered votes entitled to submit a proxy or vote at the special meetingand therefore will have no effect onnot affect the outcome of the Adjournment Proposal. An abstentionvote.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF MR. HAGAN, MR. LO AND DR. XANTHOPOULOS.

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As a result of a review of various independent registered public accounting firms, on May 28, 2019, our Audit Committee appointed Deloitte & Touche LLP as our independent registered public accounting firm to audit our financial statements for the fiscal year ending December 31, 2019. Accordingly, we dismissed Marcum LLP (“Marcum”), which previously served as our independent registered public accounting firm and audited our financial statements for the fiscal years ended December 31, 2017 and 2018.

During the Company’s fiscal years ended December 31, 2017 and 2018, and any subsequent interim period through the date of Marcum’s dismissal, there were no: (1) disagreements with Marcum on any matters of accounting principles or practices, financial statement disclosure, or auditing scope and procedures which, if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference to the subject matter of the disagreement in connection with their reports on the Company’s financial statements, or (2) there were no “reportable events” as that term is described in Item 304(a)(1)(v) of Regulation S-K of the rules and regulations of the SEC, during the Company’s years ended December 31, 2017 and 2018 or in any subsequent interim period through the date of Marcum’s dismissal. The audit reports of Marcum on the Company’s financial statements for the years ended December 31, 2017 and 2018, did not contain an adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles, except that both of the reports included an explanatory paragraph with respect to the Company’s ability to continue as a going concern. The financial statements did not include any adjustments that might have resulted from the outcome of this uncertainty.

The Company provided Marcum with a copy of the disclosures made in a Current Report on Form 8-K (the “Report”) prior to the time the Report was filed with the SEC. The Company requested that Marcum furnish a letter addressed to the SEC stating whether or not it agrees with the statements made therein. A copy of Marcum’s letter dated May 31, 2019, was attached as Exhibit 16.1 to the Report.

Our Audit Committee is responsible for selecting and appointing our independent registered public accounting firm, and this appointment is not required to be ratified by our stockholders. However, our Audit Committee has selected Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 and recommended that the Board of Directors submit this matter to the stockholders as a matter of good corporate practice. If the stockholders fail to ratify the appointment, then the Audit Committee will reconsider whether to retain Deloitte & Touche LLP and may retain Deloitte & Touche LLP or another without re-submitting the matter to our stockholders. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

The affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by proxy at the meeting and entitled to vote is required for the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. Abstentions will have the same effect as a vote against

this proposal. Brokers have authority in the

Adjournment Proposal.Doabsence of timely instructions from their beneficial owners to vote on this proposal. As a result, there will be no broker non-votes for this proposal.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE PROPOSAL TO RATIFY THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2020.

INFORMATION ABOUT OUR BOARD OF DIRECTORS AND MANAGEMENT

Board Composition

Our Board of Directors currently consists of seven members, and there are no contractual obligations regarding the election of our directors. Each of our directors holds office until the director’s successor has been elected and qualified or until the director’s earlier death, resignation or removal.

Our Certificate of Incorporation and our Bylaws provide that the authorized number of directors may be changed only by resolution adopted by a majority of the authorized number of directors constituting the Board of Directors. Our Certificate of Incorporation and Bylaws also provide that a director may be removed only for cause by the affirmative vote of the holders of at least 66-2/3% of the voting power of all the then outstanding shares of capital stock of the Company entitled to vote generally at an election of directors, and that any vacancy on our Board of Directors, including a vacancy resulting from an increase in the authorized number of directors constituting the Board of Directors, may be filled only by vote of a majority of our directors then in office.

In accordance with the terms of our Certificate of Incorporation and Bylaws, our Board of Directors is divided into three classes, designated as Class I, Class II and Class III, with members of each Class serving staggered three-year terms, divided as follows:

the Class I directors are Dr. Grais and Mr. Walker whose terms will expire at our annual meeting of stockholders to be held in 2021;

the Class II directors are Mr. Elms and Mr. Greathouse, whose terms will expire at our annual meeting of stockholders to be held in 2022; and

the Class III directors are Mr. Hagan, Mr. Lo and Dr. Xanthopoulos, whose terms will expire at this year’s annual meeting of stockholders.

Upon the expiration of the term of a Class of directors, directors in that Class are eligible, if nominated, to be elected for a new three-year term at the annual meeting of stockholders in the year in which their term expires.

Our common stock is listed on the Nasdaq Capital Market tier of The Nasdaq Stock Market LLC (“Nasdaq”). Under the listing requirements and rules of Nasdaq, independent directors must comprise a majority of a listed company’s Board of Directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and compensation committee members must satisfy heightened independence criteria set forth in the Nasdaq rules. Under the Nasdaq rules, a company’s Board of Directors must affirmatively determine whether or not each director qualifies as an “independent director.” A director will only qualify as an “independent director” if, in the opinion of the company’s Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In order to be considered to be independent for purposes of Rule 10A-3 under the Exchange Act, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the Audit Committee, the Board of Directors or any dissenters’other board committee: (1) accept, directly or appraisal rights with respect toindirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the matterslisted company or any of its subsidiaries.

Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that each of Mr. Elms, Dr. Grais, Mr. Greathouse, Mr. Hagan and Dr. Xanthopoulos is, and prior to his resignation from our Board of Directors on October 5, 2019, Dr. Wilson was, an “independent director” as defined under Rule 5605(a)(2) of the Nasdaq Listing Rules, and that Mr. Lo, our President and Chief Executive Officer, and Mr. Walker, our former President and Chief Executive Officer, are not “independent directors.” In addition, the Board of Directors determined that each of Dr. Grais, Mr. Greathouse and Mr. Hagan is an “independent director” as defined under Rule 10A-3 under the Exchange Act. In making this determination, our Board of Directors considered the relationships that each non-employee director has with our company and all other facts and circumstances our Board of Directors deemed relevant in determining the independence of such directors, including the beneficial ownership of our capital stock by each non-employee director and by entities with which each non-employee director is associated.

As of January 1, 2019, our Board of Directors consisted of Mr. Elms, Mr. Greathouse, Mr. Hagan, Dr. Troy Wilson, Mr. Walker and Dr. Xanthopoulos. Dr. Grais was appointed to fill a vacancy on our Board of Directors as a Class I Director on January 14, 2019. Dr. Wilson resigned from our Board of Directors on October 5, 2019, and Mr. Lo was appointed to the Board of Directors to fill the vacancy on our Board of Directors as a Class III Director, effective as of October 21, 2019, the date he began his role as our President and Chief Executive Officer.

Board of Directors Role in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Chief Executive Officer is responsible for setting the strategic direction for our company and the day-to-day leadership and performance of the Company, while the Chairman of the Board provides guidance to the Chief Executive Officer and presides over meetings of the full Board of Directors. Our non-employee directors meet in executive session on a regular basis, without our Chief Executive Officer present. Our Board of Directors believes that the current separation of Chairman and Chief Executive Officer allows the Chief Executive Officer to focus his time and energy on operating and managing the Company and leverages the experience and perspectives of the Chairman. During 2019, Mr. Greathouse served as our lead independent director until December 10, 2019. In his role as lead independent director, Mr. Greathouse presided over the executive sessions of the independent directors and served as a liaison to management on behalf of the independent members of the Board of Directors. Periodically, our Board of Directors assesses these roles and the board leadership structure to ensure the interests of the Company and its stockholders are best served. In light of the leadership structure of the Board of Directors, our Board of Directors determined that both a Chairman and lead independent director were no longer necessary and determined that its current structure is in the best interests of the Company and its stockholders at this time because among other reasons, separating the Chairman and Chief Executive Officer roles allows us to effectively and efficiently develop and implement corporate strategy that is consistent with the oversight role of the Board of Directors, while facilitating strong day-to-day executive leadership.

Our Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through the Board of Directors as a whole, as well as through various standing committees of our Board of Directors that address risks inherent in their respective areas of oversight. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance practices, including whether they are successful in preventing illegal or improper liability-creating conduct.

Board Committees

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees, which are the only standing committees of our Board of Directors, operates under a charter that has been approved by our Board of Directors. A current copy of the charter for each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee is available on our website, which is located at www.zosanopharma.com, under “Investors—Corporate Governance.”

Audit Committee. The current members of our Audit Committee are Dr. Grais, Mr. Greathouse and Mr. Hagan, with Mr. Hagan serving as the Chair of the Audit Committee. Previously in fiscal year 2019, our Audit Committee had consisted of Mr. Hagan, Mr. Greathouse and Dr. Wilson; Mr. Greathouse resigned as a member of the Audit Committee effective as of February 26, 2019 and was reinstated as a member of the Audit Committee on October 10, 2019, after the resignation of Dr. Wilson from our Board of Directors. Our Board of Directors has determined that each of Dr. Grais, Mr. Greathouse and Mr. Hagan meets, and prior to his resignation on October 5, 2019, that Dr. Wilson satisfied, the Nasdaq independence standards and the independence standards of Rule 10A-3(b)(1) under the Exchange Act. Each of the members of our Audit Committee meets, and prior to his resignation, Dr. Wilson met, the requirements for financial literacy under applicable rules and regulations of the SEC and Nasdaq. The Board of Directors has also determined that Mr. Hagan qualifies as an “audit committee financial expert,” as defined by applicable rules of Nasdaq and the SEC.

The Audit Committee assists our Board of Directors in its oversight of:

the integrity of our financial statements;

our compliance with legal and regulatory requirements;

the qualifications and independence of our independent registered public accounting firm; and

the performance of our independent registered public accounting firm.

The Audit Committee has direct responsibility for the appointment, compensation, retention and oversight of the work of our independent registered public accounting firm. The Audit Committee establishes and implements policies and procedures for the pre-approval of all audit services and all permissible non-audit services provided by our independent registered public accounting firm and reviews and approves any related person transactions entered into by us.

The Audit Committee met in person or by telephone five times during fiscal year 2019.

Compensation Committee. The current members of our Compensation Committee are Mr. Elms, Mr. Greathouse and Dr. Xanthopoulos, each of whom is an independent director. Dr. Xanthopoulos serves as the Chair of the Compensation Committee.

The Compensation Committee:

approves the compensation and benefits of our executive officers;

reviews and makes recommendations to the Board of Directors regarding benefit plans and programs for employee compensation; and

administers our equity compensation plans.

Pursuant to our Amended and Restated 2014 Stock Option and Incentive Plan, as amended (the “2014 Plan”), our Compensation Committee may delegate to our Chief Executive Officer all or part of its authority to approve certain grants of equity awards to certain individuals, subject to certain limitations including the amount of awards that can be granted pursuant to such delegated authority. Our Compensation Committee has delegated to our Chief Executive Officer the authority to approve certain grants of awards under the 2014 Plan to new employees below specified levels of responsibility.

Since July 2015, our Compensation Committee has retained Radford, a national executive compensation consulting firm. Radford was engaged to assist in developing an appropriate peer group for executive pay benchmarking, assist the Compensation Committee in developing appropriate incentive plans for our executives and non-executive level employees and to provide the Compensation Committee with advice and ongoing recommendations regarding material compensation decisions. In compliance with the disclosure requirements of the SEC regarding the independence of compensation consultants, Radford addressed each of the six independence factors established by the SEC with the Compensation Committee. Each of the responses affirmed the independence of Radford on executive compensation matters. Based on this assessment, the Compensation Committee determined that the engagement of Radford does not raise any conflicts of interest or similar concerns. The Compensation Committee also evaluated the independence of other outside advisors to the Compensation Committee, including outside legal counsel, considering the same independence factors and concluded their work for the Compensation Committee does not raise any conflicts of interest.

The Compensation Committee met in person or by telephone one time during fiscal year 2019.

Nominating and Corporate Governance Committee. The current members of our Nominating and Corporate Governance Committee are Mr. Elms, Dr. Grais and Mr. Greathouse. Dr. Grais is the Chair of the Nominating and Corporate Governance Committee. Previously in fiscal year 2019, our Nominating and Corporate Governance Committee consisted of Mr. Elms, Mr. Greathouse and Dr. Wilson; Dr. Wilson resigned as a member of the Nominating and Corporate Governance Committee on October 5, 2019. Each of Mr. Elms, Dr. Grais and Mr. Greathouse is, and prior to his resignation, Dr. Wilson was, an independent director.

The Nominating and Corporate Governance Committee:

identifies individuals qualified to become members of the Board of Directors;

recommends to the Board of Directors nominations of persons to be

voted on atelected to the

special meeting?No.Board of Directors; and

advises the Board of Directors regarding appropriate corporate governance policies and assists the Board of Directors in achieving them.

The Nominating and Corporate Governance Committee met in person or by telephone one time during fiscal year 2019.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2019, our Compensation Committee consisted of Mr. Elms, Mr. Greathouse and Dr. Xanthopoulos. None of our stockholdersexecutive officers serves, or in the past has served, as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board of Directors or our Compensation Committee. None of the members of our Compensation Committee is an officer or employee of the Company, nor has any dissenters’of them ever been an officer or appraisal rights with respectemployee of the Company. Mr. Elms had related person transactions requiring disclosure under Item 404 of Regulation S-K. See “Certain Relationships and Related Person Transactions.”

Code of Business Conduct and Ethics; Corporate Governance Guidelines

We have adopted a written code of ethics that applies to

the matters to be voted on at the special meeting.What are the solicitation expenses and who pays the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Ourour directors, executive officers and employees, may solicit proxiesand we also have adopted corporate governance guidelines. A copy of our code of ethics is posted on our website, which is located at www.zosanopharma.com, under “Investors—Corporate Governance.” If we make any substantive amendments to, or grant any waivers from, a provision of our code of ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website.

Meetings of the Board of Directors

Our Board of Directors met in person or by telephone 11 times during fiscal year 2019. No director attended fewer than 75% of the aggregate number of meetings of the Board of Directors and of any committee of the Board of Directors on which he or she served, in each case held during the period in which he or she served as a director, in fiscal year 2019.

Policy Regarding Board Attendance

Our directors are expected to attend meetings of the Board of Directors and meetings of committees of the Board of Directors on which they serve. Our directors are expected to spend the time needed at each meeting and to meet as frequently as necessary to properly discharge their responsibilities. We encourage members of our Board of Directors to attend our annual meeting of stockholders, but we do not have a formal policy requiring them to do so. Our last annual meeting of stockholders held on June 20, 2019 and the adjournment of the meeting held on July 18, 2019 were attended by one of the members of our Board of Directors.

Director Candidates and Selection Process

Our Nominating and Corporate Governance Committee, in consultation with our Board of Directors, is responsible for identifying and reviewing candidates to fill open positions on the Board of Directors, including positions arising as a result of the removal, resignation or retirement of any director, an increase in the size of the Board of Directors or otherwise, and recommending to our full Board of Directors candidates for nomination for election as directors. In evaluating the qualifications of candidates, the Nominating and Corporate Governance Committee will consider any requirements of applicable law and Nasdaq listing standards, a candidate’s strength of character, judgment, business experience and specific areas of expertise, familiarity with our industry, principles of diversity, factors relating to the composition of our Board of Directors (including its size and structure), and such other means. Wefactors as the Nominating and Corporate Governance Committee deems to be appropriate. The goal of the Nominating and Corporate Governance Committee is to assemble a Board of Directors that consists of individuals who bring a variety of complementary attributes and who, taken together, have the appropriate skills and experience to oversee our business. The Nominating and Corporate Governance Committee is responsible for reviewing from time to time the criteria it uses to evaluate the qualifications of candidates.

Our Nominating and Corporate Governance Committee has not adopted any formal policy, guidelines or procedures regarding the diversity of our Board of Directors. Our priority in selection of members of the Board of Directors is identification of members who will reimburse brokersfurther the interests of our stockholders through an established record of professional accomplishment, the ability to contribute positively to the collaborative culture among members of the Board of Directors, knowledge of our business and understanding of the competitive landscape.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than five percent (5%) of our common stock for at least a year as of the date such recommendation is made, to the Nominating and Corporate Governance Committee, c/o Secretary, Zosano Pharma Corporation, 34790 Ardentech Court, Fremont, California 94555. Assuming that appropriate biographical and background material is provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates that it recommends. If the Board of Directors resolves to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy card for the next annual meeting of stockholders. Any recommendation of a potential director nominee should also include a statement signed by the proposed nominee expressing a willingness to serve as a director if elected. As part of this responsibility, the Nominating and Corporate Governance Committee will be responsible for conducting, subject to applicable law, any and all inquiries into the background and qualifications of any candidate for election as a director and such candidate’s compliance with the independence and other nominee holders of shares for expenses they incur in forwarding proxy materialsqualification requirements established by the Nominating and Corporate Governance Committee or imposed by applicable law or listing standards.

Mr. Lo was appointed to the

beneficial ownersBoard of

those shares. We may retainDirectors on October 21, 2019 to fill a vacancy on the

servicesBoard of

Directors, and therefore is standing for election as a

proxy solicitation firmdirector by stockholders for the first time. Mr. Lo was recommended to

assist us in this solicitation.Where can I find voting results?

The Company expects to publishour Board of Directors and its Nominating and Corporate Governance Committee upon the voting results in a current report on Form8-K, which it expects to file with the SEC within four business days following the special meeting.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summaryrecommendation of the information contained in this Proxy Statement. We urge youChairman of our Board of Directors and our then Chief Executive Officer and certain non-management directors.

Communications with our Board of Directors